Accounts

Even though Centsible focuses on the budget, account's are still a very important part of the process. For this reason we support both on and off budget accounts. Let's learn more about accounts below.

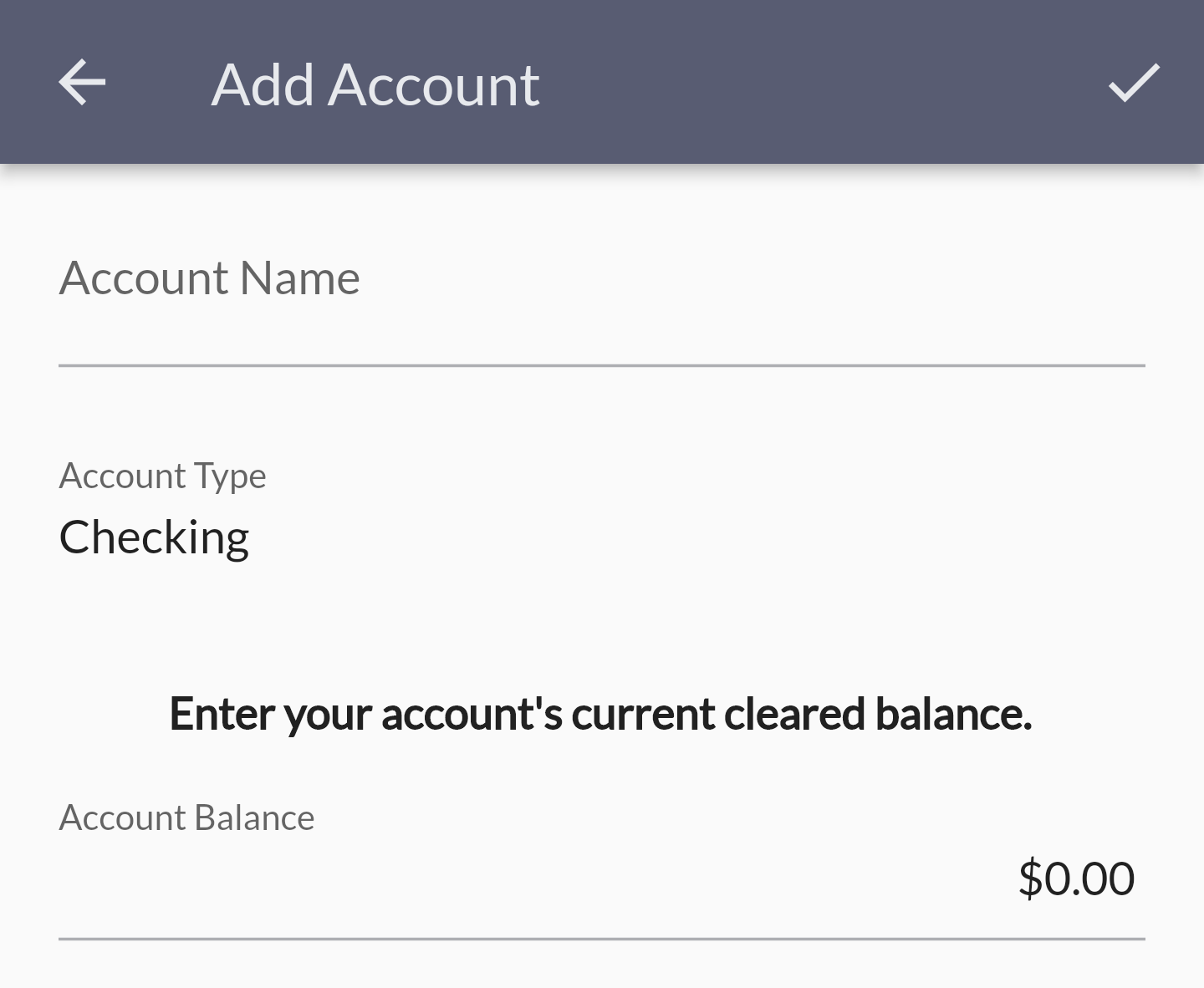

Add Account

In order to add an account:

- Go to the account tab.

- Click the plus icon at the top right.

- In the account form enter the name, select an account type, and enter an initial balance if available.

That's it!

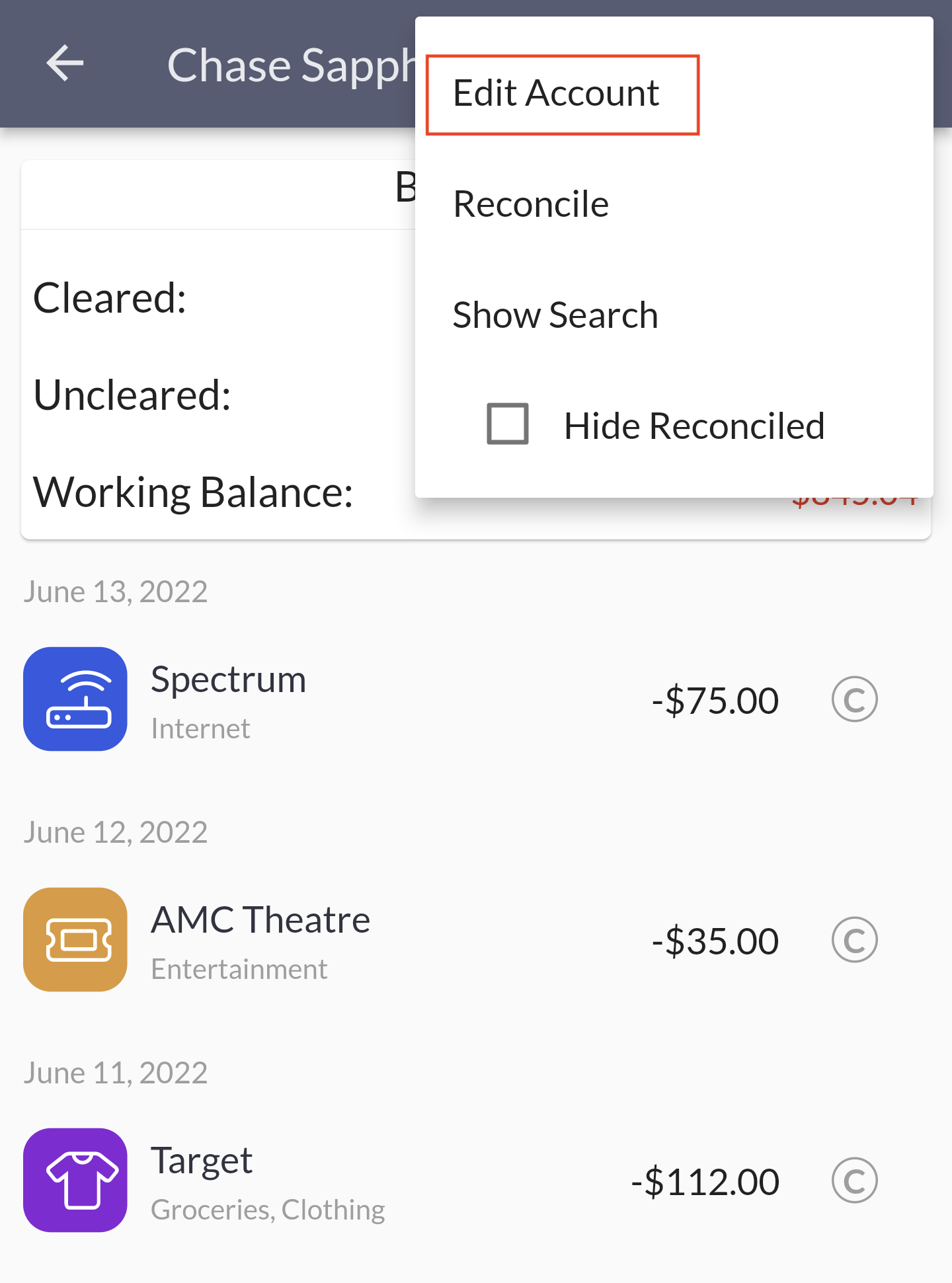

Edit Account

In order to edit an account follow these steps:

- Go to accounts tab.

- Click on the account card you want to edit.

- On that next screen (transactions screen) click on the overflow icon at the top right.

- Click edit account which will take you to a screen to edit the name of the account.

On Budget Vs Off Budget

Before we go into account types, there are two terms to understand.

On Budget: on budget accounts can affect your budget.

Off Budget: off budget accounts cannot directly affect your budget and are only used for reporting purposes.

The difference should sound self explanatory. Next we'll go over why each is labeled on or off budget.

Account Types

Centsible supports several account types:

Checking & Savings: standard on budget accounts where your income lives. They're almost always positive unless you overdraft. Available Funds will normally come from these.

Other: other on budget account types that are meant to be positive, but aren't a checking or savings account. Money market accounts are an example. But there are more.

Credit: an on budget line of credit. Thes can be credit cards, or HELOCs. Basically any type of account where you can borrow money as needed that has a limit. You pay it back and can use it again.

Asset: off budget account that represents a positive balance of unrealized potential. For example, an investment account. Investments fluctuate and would be a pain to keep accurate in a budget. We only use these for reporting and networth tracking.

Liability: of budget account that reperesents a negative balance, or money you owe. Personal loans and mortgages fit well here. We only use these for reporting and networth tracking.

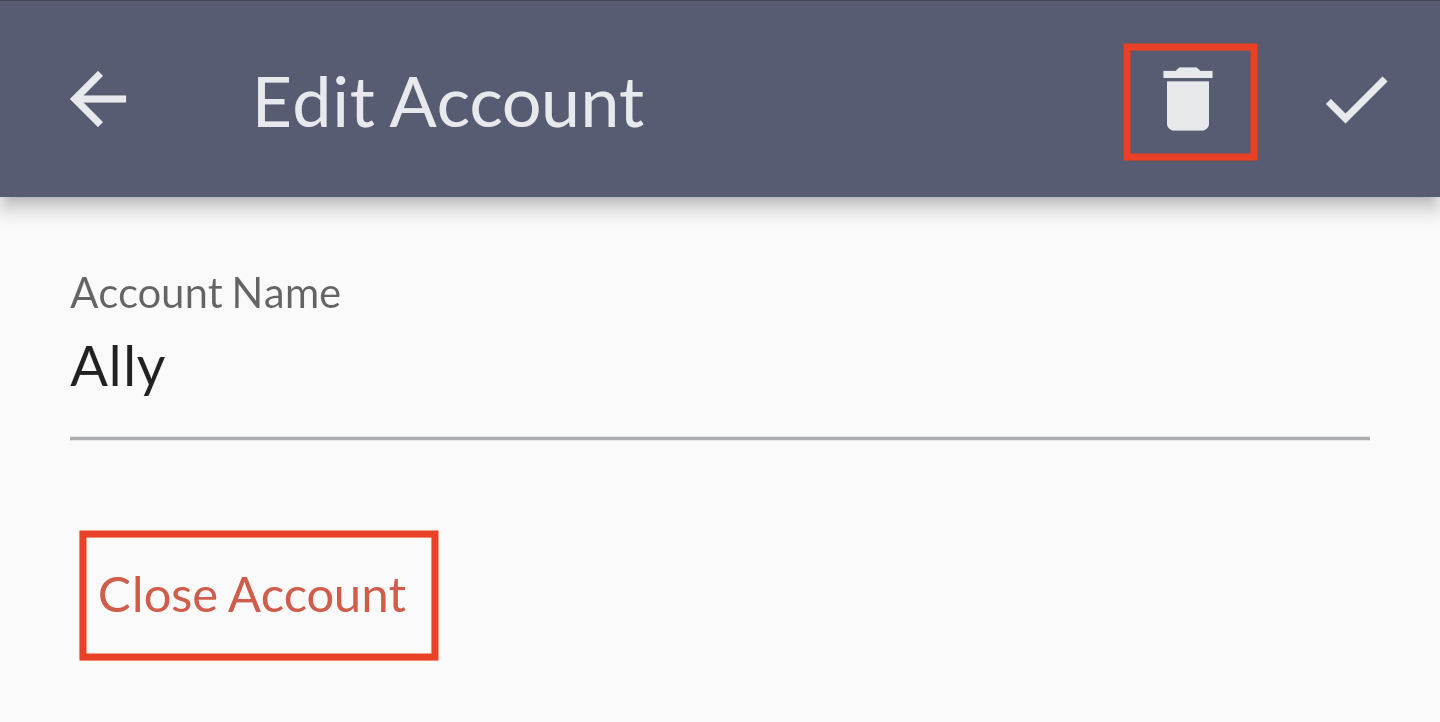

Don't Need Account Anymore?

In most cases people don't delete accounts left and right. But maybe you created your account with the wrong type. Or you are switching banks and don't need the account anymore. Let's go over how to handle this.

First we need to get to the account form screen:

- Go to accounts tab.

- Click on the account card you want to edit.

- On that next screen (transactions screen) click on the overflow icon at the top right.

- Click edit account which will take you to a screen to edit the name of the account.

In the above example you see two options highlighted. When an account has no transactions set you can delete it. The trash can icon is how you do that. If the icon has transactions asssociated, then you cannot delete it.

Once you cannot delete an account your only option is to close it. In order to do that you must make the balance of the account $0. In most cases you do this by transferring the balance to your new account. Then you'll see the option to close the account in the account edit form.