How Credit Cards Work

Budgets are hard as it is. Credit cards make it a bit more complicated. Centsible attempts to provide you with a credit card system that works with your budget rather than against it. That being said, it isn't something that is immediately obvious. This guide will help.

Adding A Credit Card

When adding a credit card account to your budget you will notice an extra thing happen. A new category is created for you in the budget screen under the Credit Card Payments group. But why?

The Problem

Let's take a hypothetical example where your grocery budget has $100 in it. You want points, so you use your credit card. You purchase $50 in groceries using your credit card. How should this be reflected in your budget?

The standard thing most budgeting apps do is just subtract $50 from your groceries tab. Now the money is gone from your budget. In theory this is fine. But let's say your card has previous debt. You only want to pay what you spent this month. How can you easily do that? There isn't an easy way. In addition, subtracting the $50 from your grocery category and making it disappear does not reflect reality. That money is in fact still in your budget. Talk about a headache.

How Credit Cards Are Handled

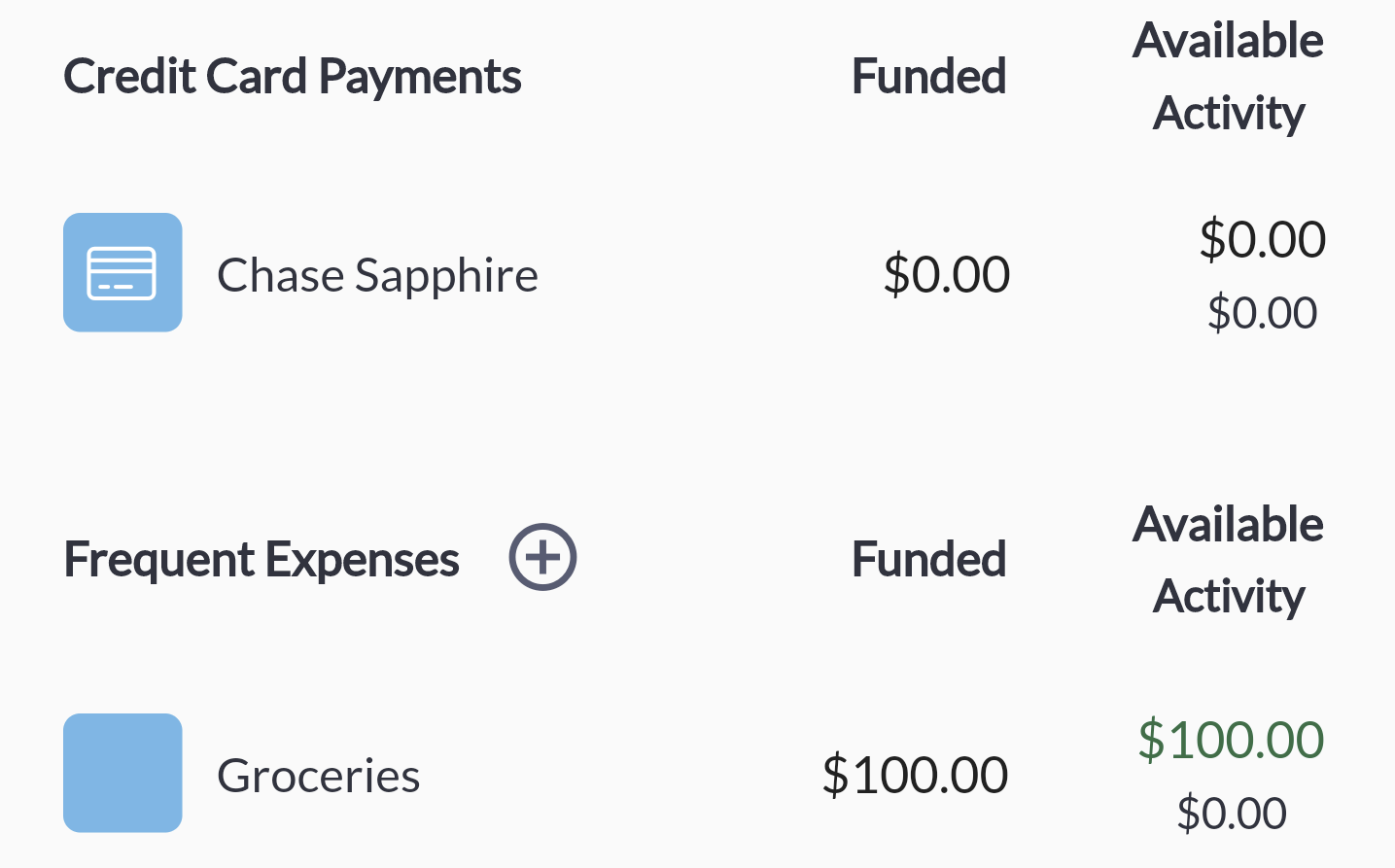

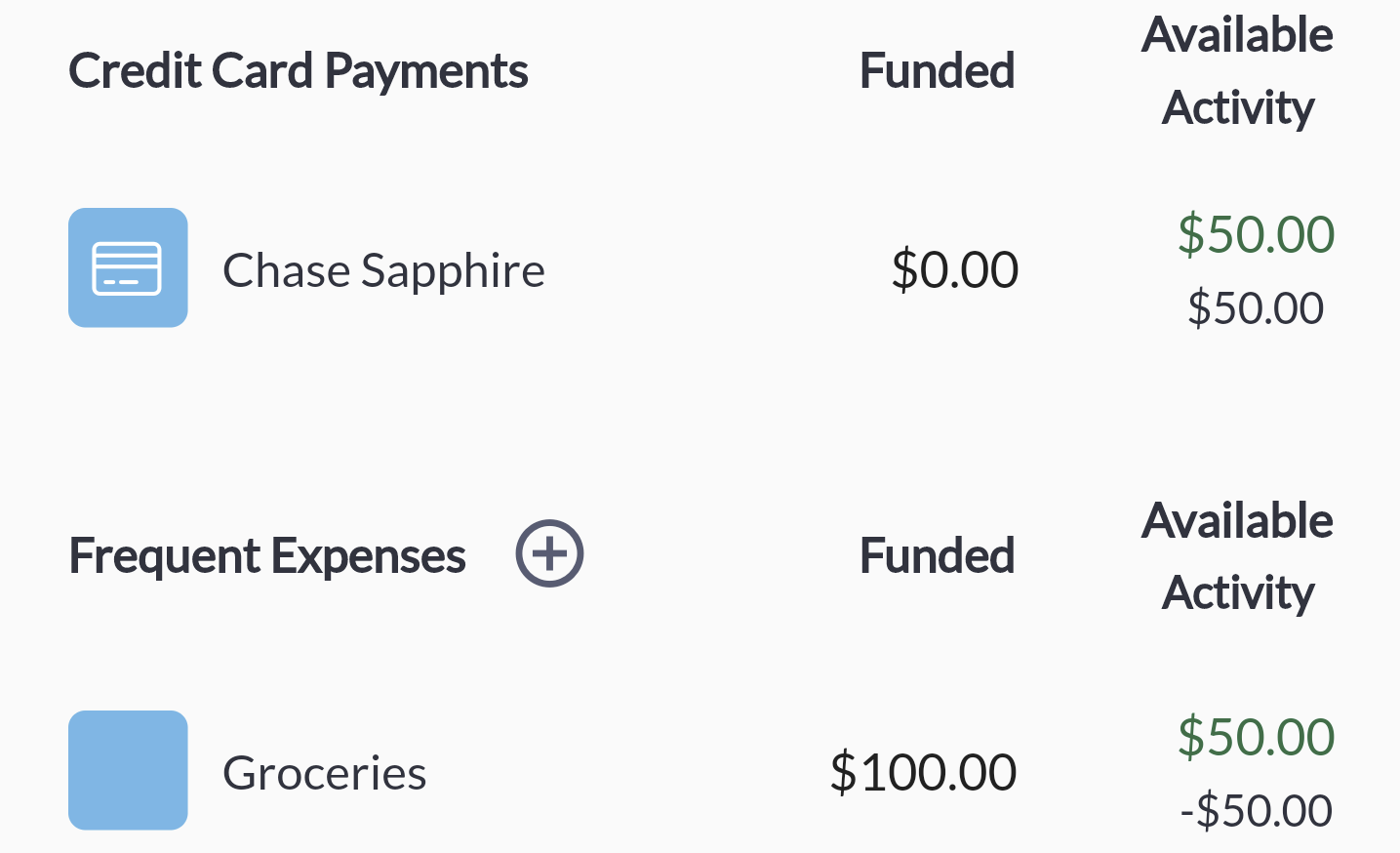

Let's continue with our hypothetical example of a grocery budget with $100 dollars. We'll run through a few scenarios that illustrate how credit cards function in Centsible.

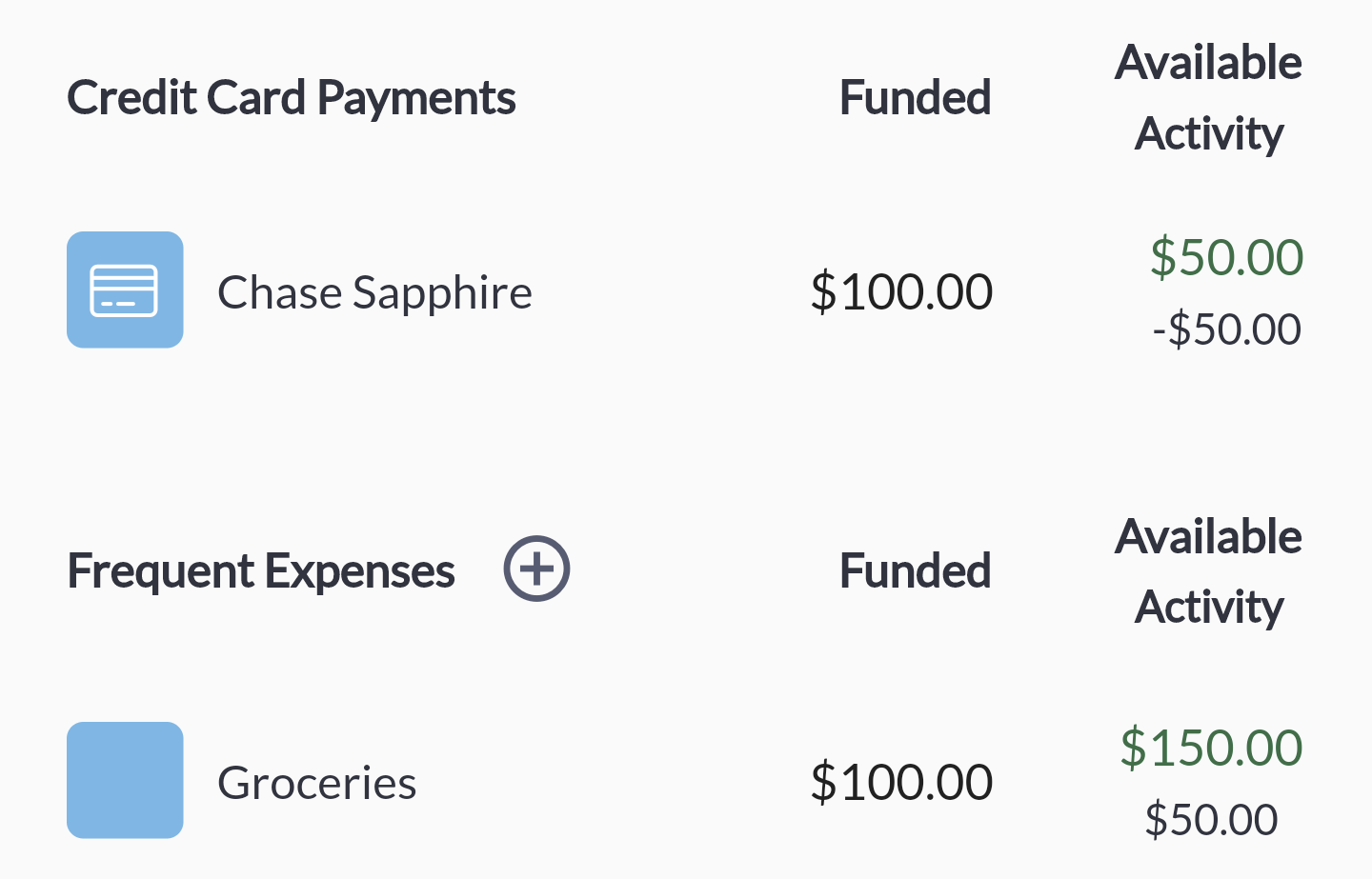

-$50 Grocery Transaction On Credit

Let's recap. The grocery category was $100. The credit category was $0. After a $50 transaction on credit, the credit category now has $50, but the grocery category also has $50. In this scenario when it comes time to pay the credit card, it's crystal clear how much you owe for this months activity.

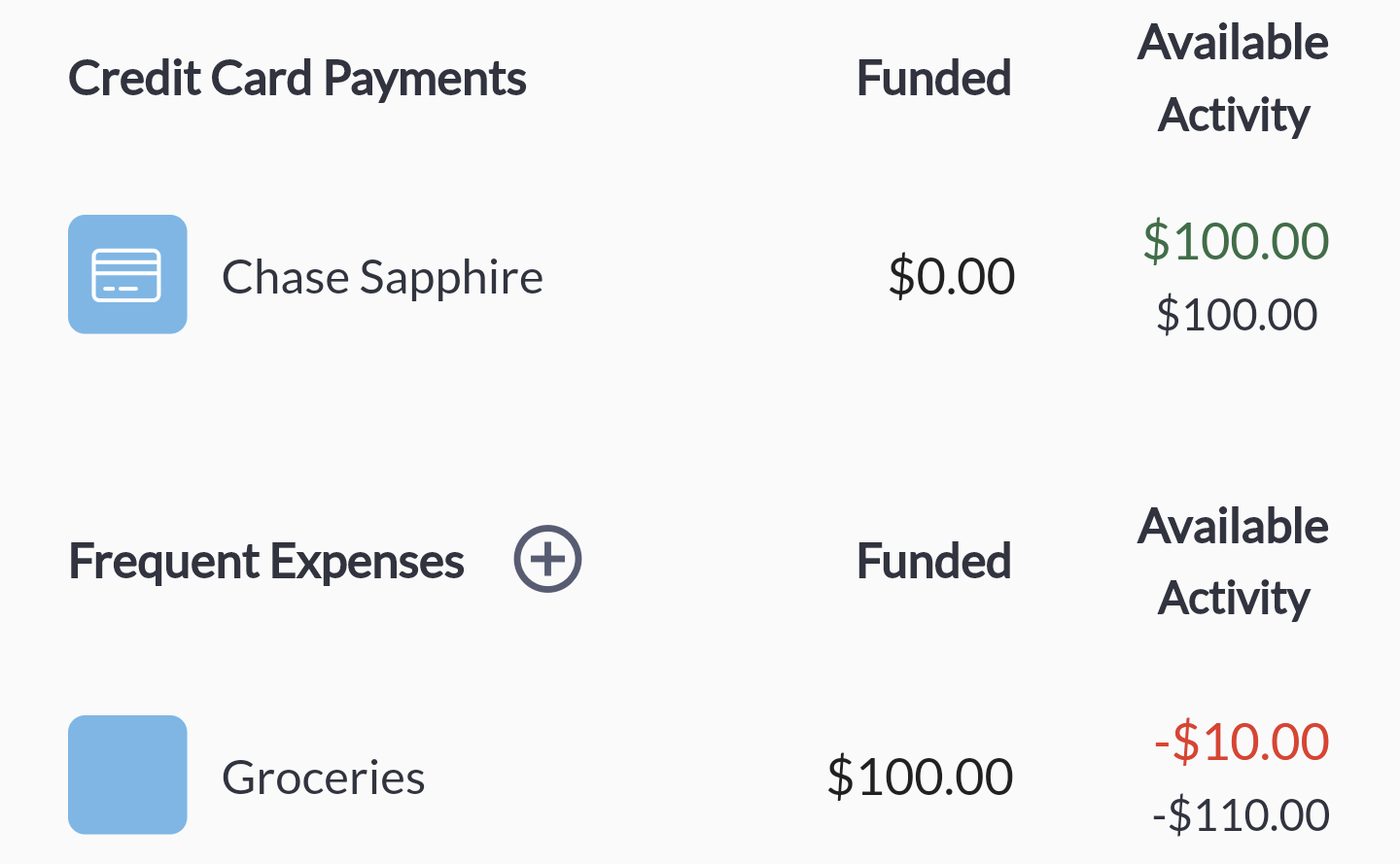

-$110 Grocery Transaction On Credit

What happens if we spend more than we had in our category? You can see that the credit category has the full amount that was available in the grocery category of $100. This reflects the reality of how much money you actually have to pay the credit card.

You could have the money available in another category. In this situation you'd normally cover the overspending though. But if you can't you simply incur debt. When the next month rolls around the overspending actually disappears.

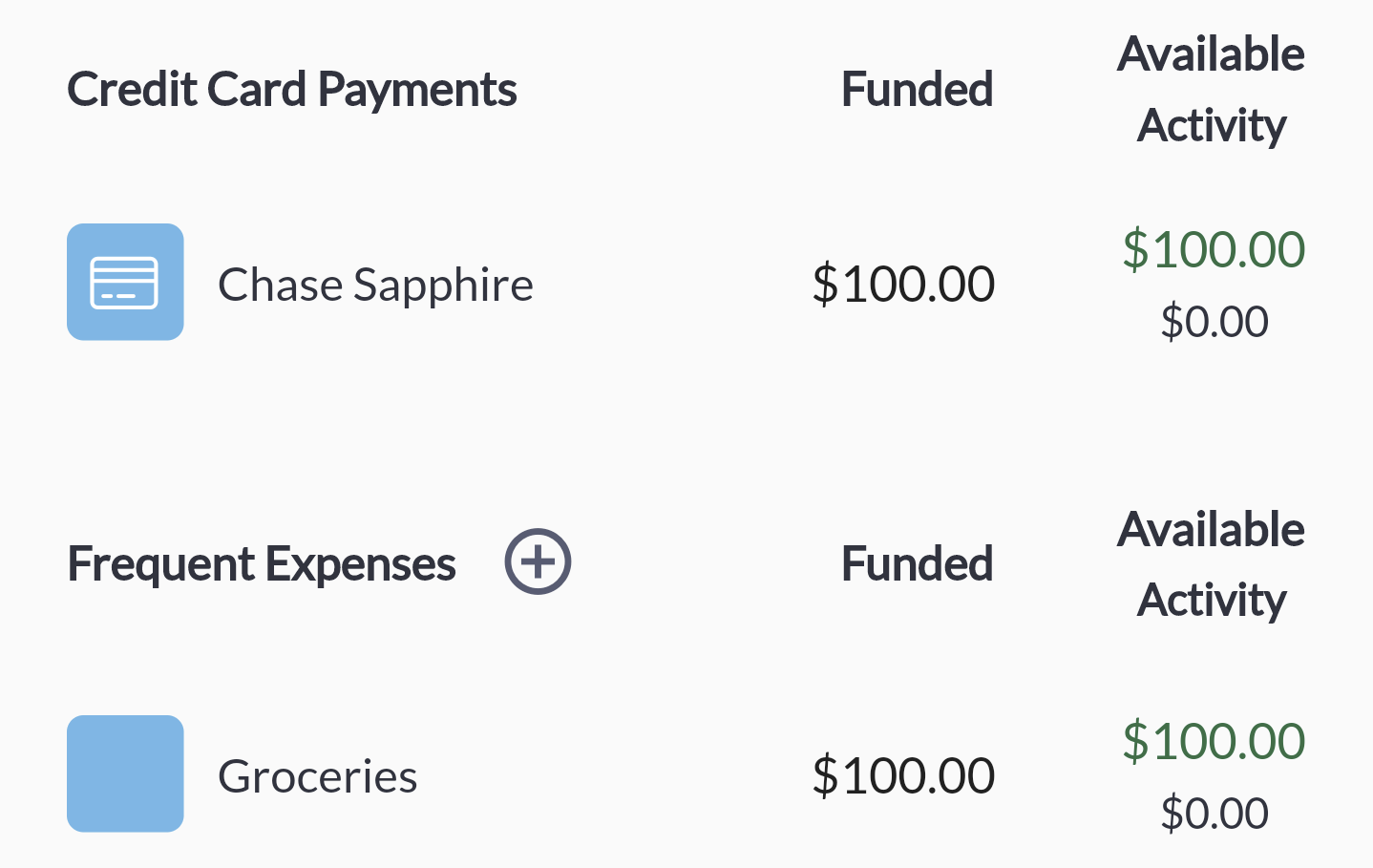

+$50 Refund from Grocery To Credit

Let's slightly change up the scenario where we have a grocery category that still has $100. But now the credit category has $100 as well. What happens if the grocery store issues a refund on your credit card?

Before

After

This example illustrates that the automatic money movement with credit works both ways. When a refund is issued and you categorize the transaction as groceries, if the money is available in the credit category it will be moved back. If the money is not available it will be ignored.

Paying Your Credit Card

Paying your credit is simple.

- Open the transaction form.

- Add the amount you are paying. Use the amount you see in the credit account available section.

- Select transfer.

- In the "From Account" select the account you will pay the credit account from. Usually it's your asset account.

- In the "To Account" select the credit card you are paying.

- A category is not needed. Enter the transaction.

Now when you go look at your credit category the available amount will have the amount that you just paid subtracted.